Homeownership schemes for first-time buyers

Learn about homebuying schemes that help you get onto the property ladder

What is a government homeownership scheme?

Government schemes help prospective first-time buyers get onto the property ladder. They're usually aimed at those who might be struggling to afford the deposit that comes with buying a new home.

It’s getting more and more expensive to get on the property ladder. But there are many government-backed schemes to help you buy your first home.

If you're still not sure which government scheme is suitable for your situation, give us a call free of charge to chat with one of our mortgage advisers.

Lifetime ISA for first-time buyers

A Lifetime ISA (LISA) can be an effective way to help you save for a deposit (or save for retirement). With a LISA, you can contribute up to £4,000 a year, and the government subsequently add 25%; up to £1,000 a year. What’s more, you can keep saving until you’re 50.

Key points about Lifetime ISAs for first-time buyers:

You must be between the ages of 18-39 to open a LISA

The property you buy must be in the UK

The property you buy must be £450,000 or less

It must be purchased through a conveyancer or solicitor

You must buy it with a residential mortgage

You have to live there as your main residence

You can use your LISA to buy a home with another person regardless of whether or not they're also a first-time buyer

You can use the LISA to buy with another LISA holder

Learn more about LISAs in our Lifetime ISA guide.

Shared Ownership for first-time buyers

Shared Ownership allows you to buy a share of the property and pay rent on the rest. Your household income must be less than £60,000 or £90,000 if you live in London.

Our Shared Ownership breakdown covers how this works in more detail.

Mortgage Guarantee Scheme for first-time buyers

The Mortgage Guarantee Scheme aims to help first-time buyers, and some existing homeowners, afford to buy a home with a deposit as small as 5%. Mortgages issued under the scheme are backed by the government, meaning the buyer would be financially supported should they become unable to make payments.

The scheme was announced by the government in the spring budget 2021, with many mortgage lenders including Barclays, NatWest and HSBC supporting it. However, this scheme will end on 31st December 2022.

Key points on the Mortgage Guarantee Scheme:

First-time buyers and existing homeowners are eligible

The property must be residential (i.e. not a second home or a buy-to-let)

You have to live there

New builds and older properties worth up to £600,000 are eligible

The mortgage application must be between 91% and 95% of the value of the property

Only repayment mortgages are applicable (i.e. not interest-only mortgages).

Right to Buy & Right to Acquire for first-time buyers

Right to Buy aims to help council tenants buy the home they already live in. The scheme gives council tenants a discount towards buying the property.

Right to Acquire is for people currently renting homes from housing associations. The discount is smaller than what you may receive with Right to Buy, however.

Key points for Right to Buy:

Is an England-only policy. Right to Buy was abolished in Scotland and Wales in 2016 and 2019 respectively. However, there is a similar scheme in Northern Ireland called the House Sales Scheme.

A Right to Buy does not equal a right to get a mortgage.

The property you want to buy is your only home.

The property doesn't have any shared facilities with other households.

You've had a public sector landlord for three years.

You're not currently in any legal battles with a creditor.

Key points for Right to Aquire:

Housing Associations maintain the right to sell the tenant an alternative property to the one in which they live.

The discount offered is significantly less generous than that offered under the Right to Buy. The discount is a flat rate and does not vary depending on the length of the tenancy.

Learn more about the differences between Right to Buy and Right to Acquire in our dedicated guide.

First Homes scheme for first-time buyers

First Homes, launched in 2021, is a scheme designed to support local first-time buyers and key workers by offering new build homes at a discount of 30-50% compared to the market price.

Key points about First Homes:

You must be 18 or older

You must be able to get a mortgage for at least half the price of the home

The scheme is only available in England

It’s designed for local first-time buyers and key workers only

First-time buyers must not have a household income exceeding £80,000, or £90,000 in London

The local council may also set some eligibility conditions, such as prioritising homes for essential workers and those on lower incomes.

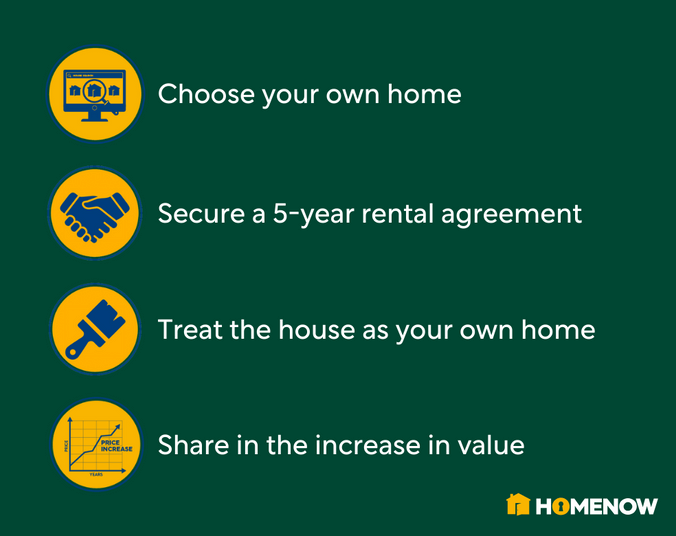

Introducing HomeNow: a 5 year deposit builder designed for renters

HomeNow gives a real boost to renter’s ability to get on the housing ladder. HomeNow purchase houses for people who don’t have enough money for a typical mortgage deposit. The ideal home is bought and held on their behalf in their HomeNow fund.

The person rents the property from the fund and, after five years, benefits from a third of the increase in value of the property (received via a rent refund). This will contribute towards a deposit, either to purchase the property they have been living in or any other property they wish to move to.

Learn more about Deposit Unlock

Deposit Unlock allows you to buy a new-build home from participating home builders with just a 5% deposit. It's been developed by the Home Builders Federation, with lenders and the house building industry.

Get a mortgage with Better.co.uk today

Our remortgage customers saved an average of £290 a month in August 2023*

Better.co.uk is a fee-free mortgage broker

5-star Trustpilot rating from over 5,000 reviews

Compare mortgage deals from over 100 lenders

Skip the paperwork: apply online any time

What people are saying about Better.co.uk...

Important info & marketing claims

You may have to pay an early repayment charge to your existing lender if you remortgage. Your savings will depend on personal circumstances.

Your home may be repossessed if you do not keep up repayments on your mortgage.

*The savings figure of £406 is based on Better.co.uk remortgage customers in February 2024. Read more on our marketing claims page.

We can't always guarantee we will be able to help you with your mortgage application depending on your credit history and circumstances.

Average mortgage decision and approval times are based on Better.co.uk's historic data for lenders we submit applications to.

Tracker rates are identified after comparing over 12,000 mortgage products from over 100 mortgage lenders.

As of January 2023, Better.co.uk has access to over 100 lenders. This number is subject to change.

For buy-to-let landlords, there's no guarantee that it will be possible to arrange continuous letting of a property, nor that rental income will be sufficient to meet the cost of the mortgage.