Rent or buy?

Which is cheaper? We weigh up the pros and cons to help you decide whether it's best to rent or buy.

Rent or buy: What’s the difference?

If you rent a home, you live in a house or flat owned by someone else.

If you buy a home, you live somewhere that belongs to you. You’ll have more rights over the property, but more responsibilities too.

Paying rent or paying a mortgage

Whether you rent or buy, you’ll need to pay for the roof over your head.

If you rent, you’ll pay your landlord rent for each month you live in the property.

If you buy, you’ll need to pay your mortgage each month until you've paid off the whole loan. You’ll then own the property outright.

Or if you have enough money, you can pay for a property in cash. This way you’ll own it from day 1.

Is it better to rent or buy?

Whether it’s best to rent or buy will depend on your personal circumstances.

Buying a home can be more cost-effective over the long term. While renting offers some flexibility and can be cheaper in the short term.

We’ve taken a look at the pros and cons of buying or renting a home.

The pros of renting

By renting you:

could find it quicker and cheaper to find a home than the buying process

may be able to rent a home in an area where you cannot afford to buy

have more flexibility. You can often move in with just 1 month's notice after the fixed term of your tenancy. This could be 6 or 12 months

will not lose money if property prices fall

do not have to pay repairs and maintenance as it's your landlords responsibility

The cons of renting

The downside to renting is that:

you will not own the property you live in

it can be hard to afford after you retire

your landlord could ask you to leave with just 2 months’ notice

your landlord can restrict what you can do in, or to, the property. For example, you’ll likely need to get permission to redecorate or own a pet

once your initial tenancy contract ends, your landlord can put the rent up

you could find it hard to get your deposit back from your landlord when you move out

The pros of buying

The benefits of buying are that:

your monthly mortgage repayments go towards owning your whole home

once you’ve paid off your mortgage you’ll no longer need to pay each month for somewhere to live

you can make bigger changes to your home, like building an extension or renovating the garden

you’ll feel more secure as a landlord cannot serve notice for you to leave

if your home’s value goes up, you could use the equity to buy a bigger home or spend it on other things. Equity is your property’s value minus your mortgage debt

The cons of buying

The downside to buying is that:

you’ll need to save a large amount of money. This is for upfront costs such as a deposit, mortgage fees, surveys, solicitors and stamp duty

it's a big commitment. You need to be sure you’re happy with what you’re buying and be planning to live there long-term

selling can take a long time

if the value of your home drops, you might fall into negative equity. This is when you owe more on your mortgage than your home is worth. Negative equity can make it difficult to sell or remortgage your home

you’ll have to pay for repairs and maintenance.

your home could be repossessed if you fall behind on your mortgage repayments

Is it cheaper to rent or buy a house?

It’s usually cheaper to rent a house in the short term. This is due to lower upfront costs, and the costs of maintaining a property.

But if your long term goal is to own a home, buying is a better investment.

The deposit

If you’re renting you usually only need a deposit of 1 month’s rent.

The average rent deposit in the UK is £1,300, according to Hamilton Fraser.¹

If you’ve paid all rent due, and not damaged the property, you should get this money back when you move out.

If you buy a property you’ll often need a deposit of at least 5% of the property’s value.

In April 2021, the average property price in the UK was around £251,000. This means a 5% deposit would be about £12,550.²

Stamp duty

You’ll also need to pay stamp duty and other costs when you buy a home.

A first time buyer paying between £425,001 and £625,000 for a home will pay a 5% stamp duty on the amount over £425,000.

In England and Northern Ireland, you do not pay stamp duty if you’re a first time buyer and your new home is under £425,000.

The Money Advice Service found buyers usually pay:

a mortgage valuation fee of between £150 and £1,500

surveyor’s fees of £250 to £600

legal fees of between £800 and £1,500

bank transfer fees of £40 to £50³

If you’re renting, you do not have to pay to repair or maintain your property. If the boiler breaks down or the roof leaks, it’s down to the landlord to fix it and pay for it.

According to LV=, UK landlords spend over £3,000 each year to maintain each rental property they own.⁴

Costs can include:

renovations and refurbishments

replacing or repairing the boiler

fixing structural damage

decorating and garden maintenance

replacing or repairing flooring

replacing white goods

If you buy a property, you would have to fund all this work yourself.

Can I afford to buy a house?

Our mortgage calculator will give you an idea of how much you might be able to borrow to buy a house.

A mortgage broker or lender can give you a more accurate figure based on your situation. When working out if you can afford to buy a house, you need to consider:

the upfront costs of buying a house

the cost of maintenance and repairs

monthly mortgage repayments

how much utility bills such as gas, electricity, water and broadband will cost

The government has several schemes in place to help you buy your first home. These include Help to Buy and shared ownership.

Read more about government schemes.

When should I buy a house?

You should only consider buying a house when you’re sure you can afford it. And that you'll be happy to stay in the property long term.

If you only live in the house for a short time or expect your circumstances to change, renting might be cheaper and more flexible.

Get a mortgage with Better.co.uk today

Our remortgage customers saved an average of £290 a month in August 2023*

Better.co.uk is a fee-free mortgage broker

5-star Trustpilot rating from over 5,000 reviews

Compare mortgage deals from over 100 lenders

Skip the paperwork: apply online any time

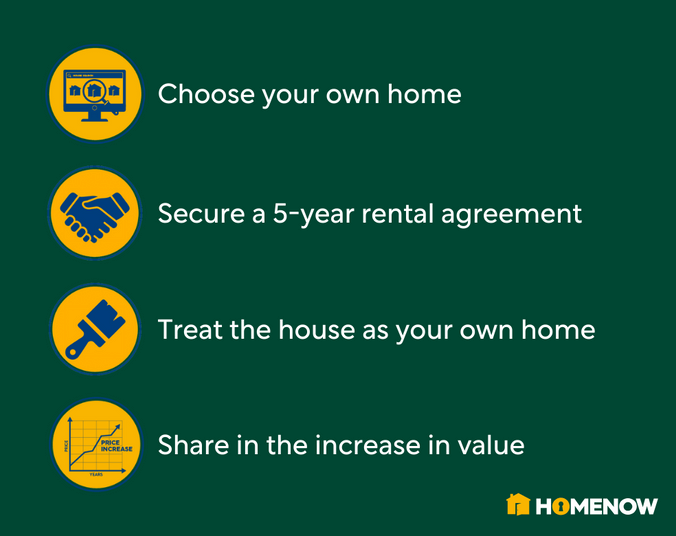

Introducing HomeNow: a 5 year deposit builder designed for renters

HomeNow gives a real boost to renter’s ability to get on the housing ladder. HomeNow purchase houses for people who don’t have enough money for a typical mortgage deposit. The ideal home is bought and held on their behalf in their HomeNow fund.

The person rents the property from the fund and, after five years, benefits from a third of the increase in value of the property (received via a rent refund). This will contribute towards a deposit, either to purchase the property they have been living in or any other property they wish to move to.

What people are saying about Better.co.uk...

Important info & marketing claims

You may have to pay an early repayment charge to your existing lender if you remortgage. Your savings will depend on personal circumstances.

Your home may be repossessed if you do not keep up repayments on your mortgage.

*The savings figure of £406 is based on Better.co.uk remortgage customers in February 2024. Read more on our marketing claims page.

We can't always guarantee we will be able to help you with your mortgage application depending on your credit history and circumstances.

Average mortgage decision and approval times are based on Better.co.uk's historic data for lenders we submit applications to.

Tracker rates are identified after comparing over 12,000 mortgage products from over 100 mortgage lenders.

As of January 2023, Better.co.uk has access to over 100 lenders. This number is subject to change.

For buy-to-let landlords, there's no guarantee that it will be possible to arrange continuous letting of a property, nor that rental income will be sufficient to meet the cost of the mortgage.